Adani Port Share Price Today: What Investors Should Know

These factors could be monitored by investors to keep track of the dynamic share market using tools like a brokerage calculator for proper management of trades to make sound decisions regarding their portfolioThese factors could be monitored by investors to keep track of the dynamic share market using tools like a brokerage calculator for proper management of trades to make sound decisions regarding their portfolios.

s.

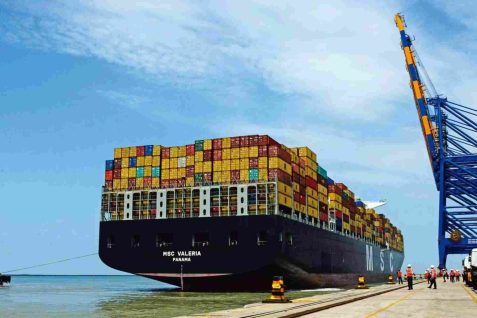

Among the largest port developers and operators in India, also a stock its logistics and infrastructure investors often keep an eye on is Adani Ports and Special Economic Zone, or APSEZ. However, as of today, the Adani Port share price reflects much more than just global trends in trade-the company’s rapidly expanding footprint in maritime infrastructure.

Adani Port Share Price Summary

As of writing, the Adani Port stock price is at ₹865.40 with a decline of 0.5% from its previous trading session. Adani Ports share, though falling by a minor percentage recently, still has shown strong resilience during the past several months based on its powerful business model and strategic expansions into new geographies.

Factors Influencing Adani Port Share Price Today

Currently, several factors are influencing the Adani Port share price, and one’s knowledge of these can guide investors towards the correct decision.

a) Expansion in Port Activities

As such, one of the strong drivers behind Adani Ports’ stock performance is its steady rising cargo volume. The firm has a number of ports spread across India, handling a significant volume of the total traffic of the nation. Growing international trade, particularly exports, had led to enhanced throughput for Adani Ports and thus impacted positively on Adani Port’s share price.

b) Strategic Acquisitions

The strategy adopted by APSEZ in acquiring and operating ports has helped the company strengthen its position as a leader in the maritime infrastructure sector in India. Through this move, the company has acquired many significant ports on both the eastern and western coasts. With these takeovers, the company has expanded its port network and increased its ability to handle different kinds of cargo, contributing positively toward revenue growth and stock price stability.

c) International Trade Flows

The fortunes of Adani Ports are further integrated into global patterns in trade. Considering the resumed supply chain with the recent uptick in volumes post-pandemic, therefore, company’s stock has been greatly influenced positively. Any form of geopolitical tensions or disruptions in international trade may directly affect the price of share in Adani Port. Investors have to be aware of global economic development that may face trade routes and shipping volumes.

d) Diversification into Logistics

Beyond port operations, the company is also looking to expand into logistics and supply chain management. Adani Ports diversified into warehousing, cold storage, and inland logistics services, thereby making it an integrated player in the maritime and logistics sector. This diversification has, of course, added another layer of stability to the stock, ensuring that Adani Ports does not predominantly look at growth emanating purely from its port operations.

Macro-economic factors which impact Adani Port Share Price 3.

a) Currency Fluctuations

Now, being a major player in international trade, fluctuations in rupee-dollar, rupee-euro, and even rupee-pound are essential to the bottom lines of Adani Ports. While a high rupee hurts the exporting business, the increase in rupee off-sets higher profitability on its export business. As such, one needs to track the movement of major currencies, especially the United States and the European Union if tracking the share price of Adani Port as an investment.

b) Interest Rates and Inflation

Like any other infrastructure player, Adani Ports is sensitive to interest rates. Higher interest rates will push the cost of expansion and acquisition funding up, and the stock price may lose strength. Inflation compresses margins with cost pushes on material and labor, which affects the performance of the stock.

c) Regulatory Change

Adani Ports falls under multiple regulatory and environmental directives. Change in government policies, trade laws, or port-related regulations can directly affect the operations of the company and, thereby influence the share price of the company. How well it handles regulations will determine the fortune of the business and continue to maintain investor confidence.

Using a Brokerage Calculator for Investment Planning

If you are to invest in the stock market in stocks like Adani Ports, you have to factor in the cost of buying and selling shares.

This is where a brokerage calculator comes into play. With a brokerage calculator, it’s easier to get the charges related to a trade, that consists of brokerage fees, tax, among others.

A brokerage calculator can be useful in determining exactly the net gain or loss from a transaction, which is a tremendous benefit of using such a tool.

Knowing beforehand what all these expenses are has been helpful in making better trade decisions and managing the investment strategy effectively.

Conclusion

There have been good tidings of strong operational performance coupled with strategic acquisitions, even in recent times when global trade patterns, regulations, and macroeconomics impinge upon Adani Port share prices in the short run, but its leadership position in India’s maritime infrastructure would offer significant long-term growth.

These factors could be monitored by investors to keep track of the dynamic share market using tools like a brokerage calculator for proper management of trades to make sound decisions regarding their portfolios.